Video 89 (2.26.20)

Weekly Questions: Video 81-100 • 14m

Talking with TaxSpeaker (Video 89)

1. I just brought on a new client and he has an S-Corp that he doesn’t pay himself wages. Instead he takes about 50% of the profits as distributions and the other 50% he pays himself as a contractor and 1099s himself. He reported this as compensation of officers. I have never seen this before. Can you do that or are you required to have wages?

2. The Secure Act allows $10,000 of 529 plan funds to pay off student loan debt. Does this apply to parents that have gotten education loans for their children, or is it just the loans that he child has is liable for? I have a client that wanted to confirm the nuances of that and I wasn’t sure.

3. Client received Form 1099 R for 1035 exchange of IRA into annuity. Form 1099 R reported Box 1 - Gross Distribution and Box 2a -Taxable amount as the same. Total Distribution Box and Taxable Amount Not Determined Box are both checked., Distribution Code is a "6" designating a 1035 exchange. Since all funds were exchanged, why is any amount reported as taxable in Box 2a? Should we asked for corrected form 1099 R?

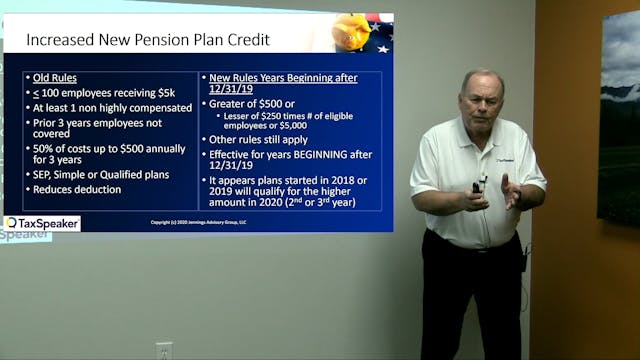

4. I have an S corp client with a SEP plan for 2 owners who are married to each other. They added a new employee in 2019 and they want to start a new plan with minimal contributions to their employee. To minimize employee contributions & costs the Simple IRA seems to make sense. However, this client has $1.2 million in annual profit and would like to defer as much as possible. Is it worth paying the fees ($3k setup and $3700 annual fee) and potentially more employee contributions to setup a deferred benefits plan where they can potentially contribute up to $150k each? I am getting conflicting opinions from different brokers.

5. I would have thought that although A new LLC owner being S-Corp, I would have thought that newly formed LLC will require Form 8832 for S-Corp election and Form 8869 Q-Sub election documentation. Then reporting on same S-Corp return by including relevant required data on Form 1120S, Page 2, Q 4. Just my opinion and not necessarily correct. That is what I have done and thought of sharing.

6. A client came in with a W-2 from Jefferson University Hospital employed as a nurse for 2018 to present. I am preparing her 2019 and no SS or Med wages or taxes .. Same for 2018. She had gone to school there and externed in 2017 so she was exempt from SS and Med for her earning in 2017,. Jefferson HR forgot to remove the SS and Med exempt for her wages as a nurse for 18 and 19 and HR said they didnt want to make changes for the past and will start withholding SS and Med going forward. I know this is not correct, Should she continue to pursue HR dept or file form 8819 for 2019 and amend 2018?

7. Can an s Corp that has never been a Corp have a additional paid in capital account?

8. I've found conflicting information regarding solar installation on residential rental property and whether it's eligible for the energy tax credit. It looks like Sec 48 and 50 do show that it would be eligible for the tax credit. Is solar indeed eligible for the energy tax credit on residential rental property? Or is it a depreciable asset? If it is eligible for the tax credit, would it be on the same Form 5695?

9. Can you provide any clarification on final year excess deductions on a 1041 K-1 to a beneficiary and whether these are deductible on Schedule A? The IRS made a mess of the situation with TCJA, and seemed to still not clarify in 2018-61. Further, the 1041 K-1 instructions indicate to place the box 11A items on line 16 of Schedule A, while the 1040 schedule A instructions make no mention of this being ok.

10. It would appear we have to prove our customer’s kids lived with the parents in order to satisfy the due diligence requirement, is this true? If yes, what documentation would satisfy this example: 4-year-old child: not in school yet, has not been to the doctor since their birth, and Mom is a stay at home Mom. What third part document would prove their son or daughter lived with them?

11. Client distributed QCD to several charities. Vanguard wrote the checks to the charities and mailed them to our client. Client then mailed the checks to the various charities, retaining the Vanguard remittance advice. Is it a requirement to also obtain an acknowledgement letter from the charity when the distribution is from an IRA, as opposed to a straightforward personal contribution?

Up Next in Weekly Questions: Video 81-100

-

Video 88 (2.21.20)

1. Does a person buying a home “on-contract” from another person, where the buyer makes payments directly to the seller, have to issue a 1099-INT to the seller? The amount is about $5,000.

2. Can I take a solar credit on rental property.

3. Are you sure you don’t have a checklist for due diligenc... -

Video 87B: Secure Act

This is the Extender Bill course we recorded at the end of the year that Bob is making available to you. This is the full course but it DOES NOT include or come with any CPE.

-

Video 87 (2.19.20)

Talking with TaxSpeaker:Video 87

1. If there is a purchase price adjustment and results in a negative # on line 8 of the worksheet B (New Gross Profit Percentage – Selling Price Reduced) , how is this reported. Essentially, they over reported the installment sale income in prior years. Can this ...